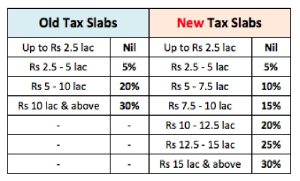

List of Individual Tax Deductions F.Y 2020-21 under Old system U/s 115 BAC

Let us currently discuss the list of personal tax deductions F.Y 2020-21 under the old tax system.

Allowances are accessible under the old tax system if you are opt-in as Old Tax Regime U/s 115 BAC.

# House Lease Allowances (HRA)

This is the popular exclusion which is utilized by numerous salaried individuals. Nonetheless, an inappropriate conviction is that whatever the lease they pay is really excluded from their pay. The fact of the matter is extraordinary. The measure of exception is least of the accompanying.

a) Real HRA Received

b) 40% of Pay (half, if house arranged in Mumbai, Calcutta, Delhi or Madras)

c) Lease paid less 10% of compensation

(Salary= Essential + DA (if part of retirement advantage) + Turnover based Commission)

Table of Contents

ToggleDownload Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

# Chilled Education Allowances:-

You can take exception up to Rs.100 every month per child (limit of up to 2 chiled). Therefore, month to month you can spare Rs.200 from this allowance.

# Child Hostel Allowances :- You can take exclusion Up to Rs. 300 every month for each Chilled up to a limit of 2 children is absolved. Therefore, you can spare around a limit of Rs.600 from this recompense.

# Standard Deduction of Rs.50,000

Rs.50,000 from FY 2019-20 and the equivalent is pertinent for FY 2020-21.

# Section 80C

This is the well-known section which often utilized by all of salaried. The most extreme breaking point for the current year is Rs.1,50,000. Therefore, up to Rs.1,50,000, you can spare tax on compensation pay from this section alone.

# Sec.80CCC

Deduction under Sec.80CCC is accessible just for individuals. Commitment to an annuity plan of the LIC of India or some other guarantor for accepting the benefits. Do recall that the sum ought to be paid or saved out of salary chargeable to tax.

The greatest measure of the deductible under Sec.80CCC is Rs.1.5 lakh. Do recall this is likewise the aspect of the consolidated furthest reaches of Rs.1.5 lakh accessible under Sec.80C, Sec.80CCC, and Sec.80CCD(1).

# Sec.80CCD(1)

The greatest advantage accessible is Rs.1.5 lakh (counting Sec.80C limit).

An individual’s greatest 20% of yearly salary (Prior it was 10% yet after Financial plan 2017, it expanded to 20%) or a workers (10% of Basic+DA) commitment will be qualified for the deduction.

The above mentioned, this section will form the piece of Sec.80C limit.

# Sec.80CCD(2)

There is a misconception among numerous that there is no furthest cutoff for this section. Be that as it may, the breaking point is least of 3 conditions.

1) Sum contributed by a business,

2) 10% of Basic +DA (14% of Government Workers) and

3) Net Complete Salary.

This is an extra deduction which won’t form the piece of Sec.80C limit.

The deduction under this section won’t be qualified for independently employed.

# NPS Tax Advantages under Sec.80CCD (1B)

This is the extra tax advantage of up to Rs.50,000 qualified for a personal tax deduction and was presented in the Spending plan 2015

Presented in Financial plan 2015. One can profit the advantage of this U/s 80CCD (1B) from FY 2015-16.

Both independently employed and representatives are qualified for profiting this deduction.

This is well beyond Section 80CCD (1).

Clarified every one of the three sections of NPS (Sec.80CCD1, Sec.80CCD2 and Sec.80CCD(1B) in beneath picture for your reference.

NOTE:- If it’s not too much trouble NOTE THAT THE Consolidated Furthest reaches OF DEDUCTION UNDER SEC.80C, SEC.80CCC AND SEC.80CCD(1) TOGETHER CAN NOT Surpass RS.1,50,000 FOR FY 2020-21.

#Sec.80D

Deduction under this section is accessible for under 60 years Rs. 25,000/ – or more 60 Years Rs. 50,000/ –

# Sec.80EEA

Alongside tax deductions under Section 80C and 24b, an individual can claim up to Rs 1.5 lakh under Section 80EEA from F.Y 2019-20. The equivalent has proceeded for F.Y 2020-21. Notwithstanding, there are sure conditions that are there for the equivalent, and they are as underneath:-

The home advance ought to have been endorsed between first April 2019 to 31st March 2020.

The Stamp duty amount of the property ought not surpass 45 Lakhs.

The taxpayer ought not to claim some other private property on the date of advance approval.

This tax advantage will be accessible from first April 2020 (AY 2020-21) and till the finish of the home credit residency (conclusion).

The absolute interest deduction is presently Rs. 3.5 lakh (Rs 2 Lakh +

Rs 1.5 Lakh).

Note that the deduction under Section 80EEA is accessible for home credits from banks and affirmed financial foundations as it were. To claim tax advantage under Section 24

# Sec.80GG:- Theo’s worker lacks the H.R.A. from the business’ no one but they can entitle the advantages U/s 80 GG @ Rs. 5,000/ – P.M. or then again Rs. 60,000/ – P.A.

Additionally, the taxpayer needs to record a revelation in Form No.10BA with respect to the consumption brought about by him towards the installment of house lease.

# Sec.80TTA

A deduction of up to Rs.10,000 can be claimed by an individual or HUF in regard to any salary by the method of interest from an investment account with a Bank/Post Office.

# Sec.80U

To claim tax benefits under Sec.80U, the taxpayer ought to be an individual and inhabitant of India. In the event that he is experiencing 40% or over 40% of any disability, then he can claim a tax deduction.

You can claim the fixed deduction of Rs.75,000. a higher deduction of Rs.1,25,000 is permitted in regard of a person with a serious disability (for example having a disability of 80% or above).

# Sec.24 (B)

House Building Credit Interest Max Rs. 2 Lakh P.A. under this section.

# Rebate under Sec.87A

The tax rebate of Rs.12,500 for individuals can get the deduction who’s taxable salary underneath Rs 5 Lakh.

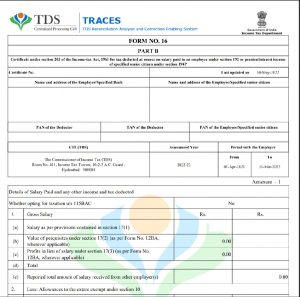

Download Automated Income Tax Preparation Excel Based Software All in One for the Non-Government (Private) Employees for the Financial Year 2020-21 and Assessment Year 2021-22 U/s 115BAC

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2020

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount into the in-words without any Excel Formula