Income Tax Section 80TTA| Under the Indian Income Tax Act, various deductions are provided to the

Indian taxpayers to reduce their income tax liability and thereby reduce their tax expenses. Similarly, These deductions can be based on salary, investment, or payment.

Therefore,

U/s 80TTA of the Income Tax Act, tax exemption is eligible to taxpayers on interest earned in a savings account. The savings account in question may be held at a bank, cooperative, or post office.

After that,

Section 80TTA was included in the Finance Act in 2013 and has since exempted many taxpayers.

In other words,

Let us examine the terms and conditions involved in availing the benefits of Section 80TTA.

Similarly, This exemption is provided U/s 80TTA– Terms and Conditions

However,

1) The conditions applicable for tax deductions under Section 80TTA are listed below:

2) A maximum of Rs.10,000 per annum can be deducted from the interest of savings accounts

Table of Contents

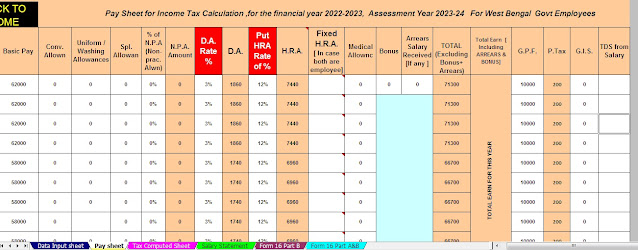

ToggleYou may also like- Autofill Income Tax Preparation Software All in One in Excel for the West Bengal State Employees for the Financial Year 2022-23

For instance, Deductions can be claimed by individuals and Hindu Unified Families (HUFs).

3) If an entity has more than one savings account with multiple banks, the combined interest income of all the accounts must be below INR 10,000 to avail of the benefit of deductions

4) In the above case, if the cumulative interest income exceeds the limit of INR 10,000, tax exemption can be claimed for INR 10,000 and the remaining amount will be taxable.

Above all, Eligibility to claim deductions under 80TTA

Under the Income Tax Act, Section 80TTA deductions can be claimed against:

(a) Taxpayers belonging to the category of natural persons or Hindu Undivided Family (HUF).

b) Indian residents

c) Non-resident Indians (NRIs) holding NRO savings accounts

(d) An organization holding savings accounts with institutions such as banks, post offices, or cooperative societies

In addition,

Claiming 80TTA Tax Deductions

Above all, Under Section 80TTA, tax deductions of up to INR 10,000 can be claimed for an eligible assessor above the limit of INR 1.5 Lac of Section 80C. Be sure to include the interest on savings accounts under the Income from other sources section when filing income taxes.

After that,

Exemption under Section 80TTA

1) If the total income of the company is less than the minimum taxable income, a person cannot claim tax exemption under section 80TTA

2) Senior citizens cannot avail of tax deductions under Section 80TTA

3) Tax exemption 80TTA does not apply to:

• Long Term Deposits

• Fixed deposits

• Recurring Deposits

• Deposits from NBFC (non-banking finance companies).

• NRA holders of NRE accounts cannot claim tax deductions under Section 80TTA as NRE accounts are tax-exempt.

Conclusion

Many savings account holders are unaware of the taxes on savings account interest. Section 80TTA of the

Conclusion

Many savings account holders are unaware of the taxes on savings account interest. Section 80TTA of the Income Tax Act 1961 covers the income tax exemption granted on interest earned on savings accounts, with a maximum exemption of INR 10,000 per annum.

Similarly, This exemption applies to Hindu undivided individuals or families (HUF).

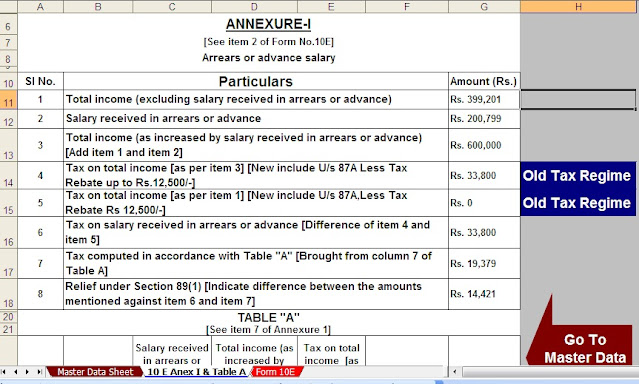

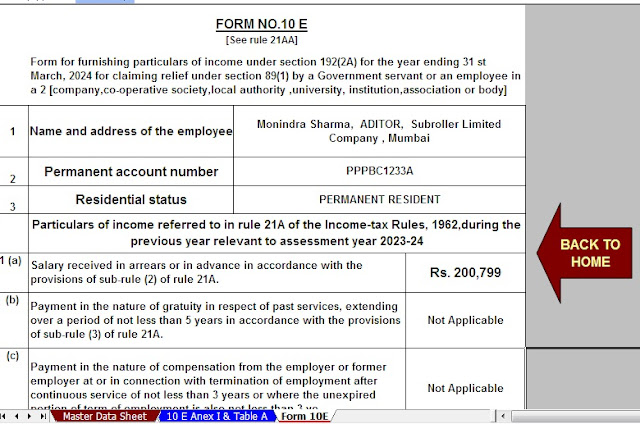

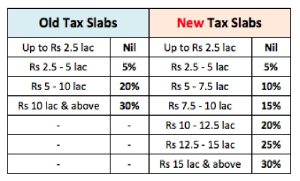

Download Automated IncomeTax Arrears Relief Calculator U/s 89(1) along with Form 10E from the Financial Year 2000-01 to Financial Year 2022-23 (Up-to-date Version)