In this digital time, managing income tax returns has become significantly more convenient, especially for West Bengal Government employees. Therefore, The advent of All-in-One Income Tax Preparation Software in Excel for FY 2023-24 is simplifying the often complex and daunting process of filing income tax returns. In other words, In this article, we will delve into the various aspects of this software and its importance for the employees of the West Bengal Government.

Table of Contents

ToggleIntroduction

However, Filing income tax returns is a crucial responsibility for every working individual, and government employees are no exception. Above all, it can be a perplexing task, particularly for those unfamiliar with the complexities of the tax system. The West Bengal Government, recognizing the need for a user-friendly solution, has introduced All-in-One Income Tax Preparation Software in Excel for the fiscal year 2023-24.

Above all, What Is All-in-One Income Tax Preparation Software?

Simplified Tax Filing

In addition, This software is a comprehensive tool designed to simplify the process of income tax filing for West Bengal Government employees. After that, It incorporates various forms and calculations required for tax returns into a single, user-friendly Excel file.

Key Features

Similarly, The All-in-One Income Tax Preparation Software offers a range of key features that make it an invaluable resource for employees:

1. User-Friendly Interface

Therefore, The software provides an intuitive and user-friendly interface, allowing even those with limited technical knowledge to navigate it effortlessly.

2. Automated Calculations

In other words, It automates complex tax calculations, minimizing the risk of errors and ensuring accurate returns.

3. Built-in Compliance Checks

However, The software includes built-in compliance checks, ensuring that users adhere to all government regulations and requirements.

4. Prompt Updates

Above all, Regular updates are provided to keep the software in line with changing tax laws and regulations.

In addition, Benefits of Using All-in-One Income Tax Preparation Software

1. Time-Efficiency

After that, One of the significant advantages of using this software is the time it saves. By streamlining the process, employees can complete their tax returns quickly and efficiently.

2. Error Reduction

The software significantly reduces the margin for errors. Similarly, With automated calculations and compliance checks, there is minimal room for mistakes in the filing process.

3. Enhanced Compliance

Therefore, Government employees can rest assured that they are in compliance with all tax regulations and requirements, reducing the risk of legal complications.

4. Accessibility

In other words, The software can be accessed from anywhere, making it convenient for those who are frequently on the move.

5. Real-time Updates

However, The regular updates ensure that the software remains current, incorporating any changes in tax laws.

How to Get Access

Above all, To get access to this incredibly useful software, simply click on the link provided below:

In Conclusion

The All-in-One Income Tax Preparation Software in Excel for FY 2023-24 is a remarkable tool for West Bengal Government employees. In addition, It simplifies the process of income tax filing, saving time, reducing errors, and enhancing compliance. After that, Accessible and regularly updated, it’s a must-have for anyone looking to streamline their tax filing process.

Frequently Asked Questions

1. Is this software only available to West Bengal Government employees?

No, the software is primarily designed for the convenience of West Bengal Government employees, but it may also be suitable for other taxpayers.

2. Is the software free to use?

Yes, the software is free to use, ensuring that government employees have access to a cost-effective solution for tax preparation.

3. How often is the software updated?

Similarly, The software is updated regularly to ensure it remains in compliance with the latest tax laws and regulations.

4. Can I access the software on a mobile device?

Yes, the software is accessible from various devices, including mobile phones and tablets.

5. What kind of support is available for users who encounter issues with the software?

The software typically comes with customer support to assist users with any problems or questions they may have during the tax filing process.

Download West Bengal Government Employees All-in-One Excel-Based Automated Income Tax Preparation Software Financial Year 2023-24 as per Budget 2023

Feature of this Excel Utility:-

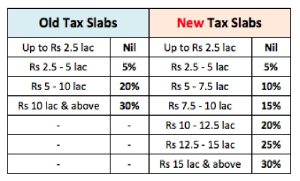

1) This Excel utility accurately calculates your income tax based on your choice under Section 115BAC

2) This Excel Utility has all amended Income Tax Sections as per Budget 2023

3) For instance, Automated Calculation of Income Tax House Rent Exemption Under Section 10(13A).

4) For instance, Personal Salary Structure for West Bengal Government Employees Salary Pattern as per ROPA-2019

5)For instance, Individual Salary Sheet

6) For instance, Individual Tax Computed Sheet

7) For instance, Automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

8) For instance, Automated Income Tax Revised Form 16 Part B for the F.Y.2023-24