Paying income tax often feels like solving a complex puzzle. However, what if the puzzle suddenly became simple, clear, and even manageable? That is exactly where Income Tax Preparation Software All-in-One in Excel steps in. For salaried employees in FY 2025–26, this Excel-based solution works like a trusted calculator that never gets tired. Moreover, it saves time, reduces stress, and improves accuracy. So, instead of fearing tax season, why not take control with a smart Excel tool that works for you?

Table of Contents

| Sr# | Headings |

| 1 | What Is Income Tax Preparation Software in Excel |

| 2 | Why Salaried Employees Need an All-in-One Tool |

| 3 | Key Features of Income Tax Preparation Software All-in-One in Excel |

| 4 | How Excel-Based Tax Software Simplifies Calculations |

| 5 | Old Tax Regime vs New Tax Regime Comparison |

| 6 | Automatic Deductions and Exemptions Handling |

| 7 | Salary Structure and Form 16 Integration |

| 8 | Accuracy, Transparency, and Error Reduction |

| 9 | Time-Saving Benefits for Busy Employees |

| 10 | Budget 2025–26 Updates and Compliance |

| 11 | User-Friendly Design for the General Public |

| 12 | Data Security and Offline Accessibility |

| 13 | Why Excel Still Beats Many Online Tools |

| 14 | Common Mistakes Avoided with Excel Tax Software |

| 15 | Final Thoughts for FY 2025–26 Tax Planning |

1. What Is Income Tax Preparation Software in Excel

Simply put, Income Tax Preparation Software All in One in Excel is a smart spreadsheet designed to calculate your tax automatically. In other words, it uses formulas to compute income, deductions, and tax liability. Furthermore, it updates totals instantly. As a result, you always see accurate figures without manual effort.

2. Why Salaried Employees Need an All-in-One Tool

Salaried employees often juggle work, family, and deadlines. Therefore, tax calculation should not add more pressure. An all-in-one Excel tool combines salary details, deductions, and tax rules in one place. Consequently, you avoid confusion and gain clarity. Most importantly, you stay compliant.

3. Key Features of Income Tax Preparation Software All-in-One in Excel

This software offers automatic calculations, regime comparison, and deduction tracking. Additionally, it includes built-in validation. Moreover, it generates summaries instantly. Hence, you enjoy both speed and accuracy.

4. How Excel-Based Tax Software Simplifies Calculations

Excel works like a well-organised notebook. Once you enter numbers, formulas do the rest. Similarly, this software behaves like a skilled accountant inside a spreadsheet. Therefore, even non-technical users feel confident.

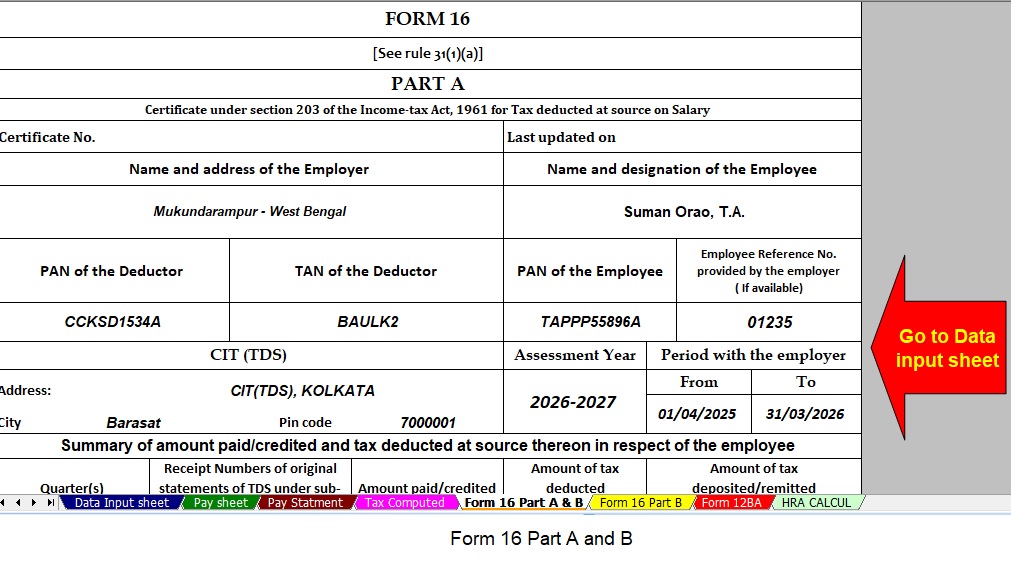

You need this Excel Utility:- Download Automatic Income Tax Form 16 Part B in Excel for the FY 2025-26[This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

5. Old Tax Regime vs New Tax Regime Comparison

Choosing between regimes can be confusing. However, this Excel software compares both regimes side by side. As a result, you instantly see which option saves more tax. Thus, decision-making becomes simple and informed.

6. Automatic Deductions and Exemptions Handling

From standard deduction to Section 80C, everything gets calculated automatically. Moreover, the tool adjusts totals instantly. Therefore, you never miss eligible benefits. In addition, it reduces manual errors.

7. Salary Structure and Form 16 Integration

Salary components like HRA, DA, and allowances fit neatly into the software. Consequently, it aligns with Form 16. Furthermore, this alignment helps during return filing. Hence, accuracy improves significantly.

8. Accuracy, Transparency, and Error Reduction

Manual calculations invite mistakes. On the contrary, Excel formulas ensure precision. Additionally, every figure remains visible. Therefore, transparency increases. In short, you trust the numbers you see.

9. Time-Saving Benefits for Busy Employees

Time matters. Instead of spending hours on calculations, you finish in minutes. Moreover, instant updates save repeated work. As a result, you focus on what truly matters.

10. Budget 2025–26 Updates and Compliance

The software aligns with FY 2025–26 tax rules. Therefore, it reflects current slabs and deductions. Consequently, compliance becomes easier. Most importantly, you avoid penalties.

11. User-Friendly Design for the General Public

This Excel tool uses simple labels and clear layouts. Hence, even beginners feel comfortable. Additionally, no technical knowledge is required. Thus, everyone can use it confidently.

12. Data Security and Offline Accessibility

Unlike online tools, Excel works offline. Therefore, your data stays with you. Moreover, you control access. As a result, privacy improves.

You need this Excel Utility:- Download Automatic Income Tax Form 16 Part A&B in Excel for the FY 2025-26[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

13. Why Excel Still Beats Many Online Tools

Excel offers flexibility. You can customise, save, and reuse data. Furthermore, no internet dependency exists. Hence, Excel remains reliable and practical.

14. Common Mistakes Avoided with Excel Tax Software

People often forget deductions or miscalculate taxes. However, this software prevents such errors. Additionally, built-in checks guide users. Therefore, accuracy remains high.

15. Final Thoughts for FY 2025–26 Tax Planning

Think of Income Tax Preparation Software All in One in Excel as a compass during tax season. It guides you clearly, steadily, and safely. Ultimately, it empowers salaried employees to plan better and worry less.

In Conclusion

In conclusion, Income Tax Preparation Software All-in-One in Excel transforms tax calculation from a headache into a smooth task. Moreover, it combines simplicity, accuracy, and flexibility. Therefore, for FY 2025–26, salaried employees should embrace this smart Excel solution and take full control of their taxes.

Frequently Asked Questions (FAQs)

- What is Income Tax Preparation Software All-in-One in Excel?

It is an Excel-based tool that automatically calculates income tax for salaried employees using built-in formulas. - Is this software suitable for non-technical users?

Yes, it uses simple layouts and requires only basic data entry. - Can it compare old and new tax regimes?

Yes, it compares both regimes and shows which one is more beneficial. - Does it support FY 2025–26 tax rules?

Yes, it aligns with the latest tax slabs and deductions for FY 2025–26. - Is Excel tax software safe to use offline?

Absolutely, it works offline and keeps your financial data secure.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

The Excel-based Income Tax Preparation Software offers a smart, reliable, and time-saving way to calculate income tax for both Government and Non-Government employees. To begin with, it simplifies complex tax rules. Moreover, it automates calculations, reduces errors, and improves accuracy. As a result, salaried employees can manage their taxes confidently and efficiently.

Key Features of the Excel-Based Tax Preparation Utility

1. Flexible Dual Tax Regime Selection

First of all, the software allows you to select either the Old Tax Regime or the New Tax Regime under Section 115BAC with ease. Furthermore, it automatically compares both regimes side by side. Consequently, you can quickly identify the option that offers the maximum tax benefit. Therefore, decision-making becomes faster and smarter.

2. Smart and Customised Salary Structure

In addition, the tool intelligently adapts to your salary structure. Whether you work in a Government department or a Non-Government organization, it adjusts automatically. Moreover, this flexibility minimises manual data entry. As a result, it saves time while improving calculation accuracy.

3. Automatic Arrears Relief Calculator (Section 89(1) with Form 10E)

Not only does the software calculate arrears relief accurately, but it also covers financial years from 2000–01 to 2025–26. Additionally, it instantly prepares Form 10E for submission. Hence, taxpayers receive correct relief without confusion or delay.

4. Updated and Revised Form 16 Generation

Similarly, the software automatically generates Revised Form 16, including Part A & Part B, for FY 2025–26. Moreover, it strictly follows the latest income tax formats. Therefore, your Form 16 remains compliant, accurate, and ready for filing.

5. Simplified and Error-Free Tax Compliance

Finally, the tool ensures smooth and hassle-free compliance. Through advanced built-in formulas and validations, it delivers fast and error-free tax calculations. Consequently, salaried employees can complete their tax tasks with confidence and peace of mind.

6. Automatic Deductions and Exemptions Management

Moreover, the software automatically calculates all eligible deductions and exemptions under the Income Tax Act. For instance, it includes Section 80C, 80D, 80E, HRA, LTA, and the standard deduction. Additionally, it updates totals instantly as you enter values. Therefore, you never miss a deduction, and as a result, your taxable income is reduced correctly.

7. Built-In Tax Slab Updates for FY 2025–26

Equally important, the Excel utility stays updated with the latest income tax slabs for FY 2025–26. Consequently, it applies the correct rates automatically. Furthermore, this feature eliminates the risk of using outdated slabs. Hence, your tax calculation remains accurate and compliant throughout the year.

8. User-Friendly Interface with Guided Input

At the same time, the software offers a clean and easy-to-use layout. Clearly labelled columns guide you step by step. Additionally, built-in instructions help even first-time users. As a result, you can complete tax preparation without professional help.

9. Instant Tax Summary and Detailed Reports

Besides calculations, the tool generates a complete tax summary instantly. Moreover, it provides a clear breakup of income, deductions, tax payable, and refunds. Therefore, you gain full transparency. In other words, you always know where your money goes.

10. Time-Saving Automation for Salaried Employees

Importantly, automation saves hours of manual work. Instead of repetitive calculations, Excel formulas do the heavy lifting. Consequently, salaried employees can focus on work and family. Thus, tax preparation becomes quick and stress-free.

11. Offline Access with Full Data Security

Unlike online tools, this Excel software works completely offline. Therefore, your financial data stays on your device. Additionally, you control who can access the file. As a result, privacy and security remain intact at all times.

12. Suitable for Both Government and Non-Government Employees

Notably, the software supports diverse salary structures. Whether you receive pay commissions, allowances, or private-sector benefits, it adapts smoothly. Hence, employees from all sectors can use a single solution without confusion.

13. Error Checks and Built-In Validations

Furthermore, the tool includes smart validations that highlight incorrect or missing entries. Consequently, it reduces mistakes before final submission. Therefore, you avoid notices and rework later.

14. Easy Return Filing Support

Finally, the software prepares data that aligns with income tax return filing requirements. Moreover, it supports smooth coordination with Form 16 and Form 10E. Hence, filing your return becomes simple and hassle-free.