Preparing Form 16 for multiple employees can feel overwhelming at first. However, once you understand the process, it becomes as simple as following a recipe step by step. After all, who doesn’t want a faster, error-free way to handle tax compliance? Therefore, this guide explains how to auto-prepare Form 16 Part A&B in Excel for 50 employees in a clear, practical, and user-friendly way. Moreover, this article uses simple language, active voice, and smooth transitions so that anyone from the general public can follow along easily.

Table of Contents

| Sr# | Headings |

| 1 | What Is Form 16 and Why It Matters |

| 2 | Difference Between Form 16 Part A and Part B |

| 3 | Why Use Excel to Prepare Form 16 |

| 4 | Benefits of Auto Preparing Form 16 in Excel |

| 5 | Documents Required Before You Start |

| 6 | How to Download Form 16 Part A |

| 7 | How to Prepare Form 16 Part B in Excel |

| 8 | Setting Up Excel for 50 Employees |

| 9 | Using Formulas to Automate Calculations |

| 10 | Common Mistakes to Avoid |

| 11 | Verification and Cross-Checking |

| 12 | Printing and Sharing Form 16 |

| 13 | Compliance Tips for FY 2025-26 |

| 14 | Why Automation Saves Time and Stress |

1. What Is Form 16 and why does it matter

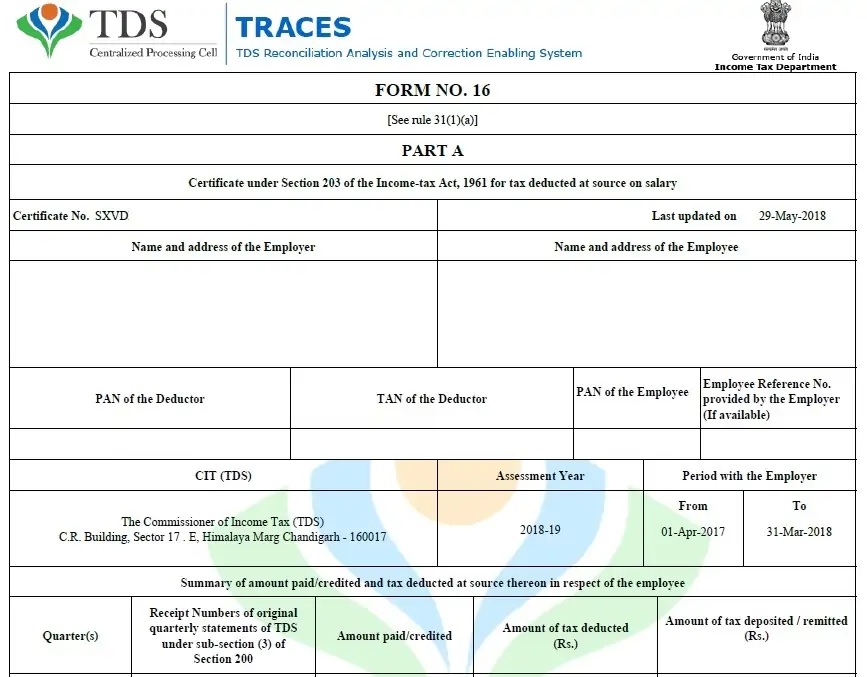

Form 16 acts like a salary report card for employees. In simple terms, it shows how much salary an employee earned and how much tax the employer deducted. Therefore, employees rely on it while filing income tax returns. Moreover, employers must issue it every year without fail.

2. Difference Between Form 16 Part A and Part B

Form 16 Part A shows employer details, employee details, and TDS deposited. On the other hand, Form 16 Part B explains salary breakup, exemptions, deductions, and tax calculation. Together, both parts complete the picture. Hence, you cannot ignore either one.

3. Why Use Excel to Prepare Form 16

Excel works like a digital notebook with superpowers. Not only does it store data, but it also calculates automatically. Consequently, when you auto-prepare Form 16 Part A&B in Excel, you reduce errors, save time, and gain control over data.

4. Benefits of Auto-Preparing Form 16 in Excel

Firstly, Excel saves hours of manual work. Secondly, it ensures consistency across all 50 employees. Additionally, formulas eliminate calculation mistakes. Most importantly, automation helps you meet deadlines without stress.

5. Documents Required Before You Start

Before you begin, gather PAN details, salary structure, TDS details, deductions, and challan information. Otherwise, missing data can delay the entire process. Therefore, preparation is the key.

6. How to Download Form 16 Part A

You must download Form 16 Part A from the TRACES portal. First, log in using employer credentials. Next, select the relevant financial year. Then, request and download Part A. Finally, verify all details carefully.

7. How to Prepare Form 16 Part B in Excel

Unlike Part A, you prepare Form 16 Part B manually or through Excel. First, create a structured Excel template. Then, enter salary components, exemptions, and deductions. As a result, Excel calculates taxable income automatically.

8. Setting Up Excel for 50 Employees

Create one master sheet and 50 individual employee sheets. Alternatively, use one sheet with rows for each employee. Either way, Excel handles bulk data smoothly. Therefore, scaling up becomes effortless.

9. Using Formulas to Automate Calculations

Formulas are the heart of automation. For example, SUM, IF, and VLOOKUP functions calculate tax instantly. Consequently, once you update one value, everything adjusts automatically. That’s the real magic.

10. Common Mistakes to Avoid

Never mismatch PAN numbers. Also, avoid incorrect tax slabs. Moreover, double-check exemptions. Otherwise, small errors may lead to big problems later.

11. Verification and Cross-Checking

Always reconcile Form 16 with Form 26Q. Additionally, cross-check totals with payroll records. Therefore, verification ensures accuracy and compliance.

12. Printing and Sharing Form 16

After finalizing, convert Excel sheets into PDF format. Then, share them digitally or print if needed. Consequently, employees receive their documents on time.

13. Compliance Tips for FY 2025-26

Follow updated tax slabs. Also, respect due dates. Furthermore, maintain proper records. Hence, compliance keeps you safe from penalties.

14. Why Automation Saves Time and Stress

Automation works like a silent assistant. It never gets tired, never forgets formulas, and never complains. Therefore, you focus on quality rather than quantity.

In Conclusion

In conclusion, learning how to auto-prepare Form 16 Part A&B in Excel for 50 employees makes life easier. Instead of struggling with manual calculations, you gain speed, accuracy, and peace of mind. Ultimately, automation transforms a complex task into a smooth routine.

FAQs

- Can I auto-prepare Form 16 Part A&B in Excel for free?

Yes, you can use Excel templates and formulas without extra cost. - Is Excel acceptable for preparing Form 16?

Yes, as long as data is accurate and compliant with tax rules. - How long does it take to prepare Form 16 for 50 employees?

With automation, it may take only a few hours. - Do I still need TRACES for Part A?

Yes, Form 16 Part A must be downloaded from TRACES. - Is automation safe for tax compliance?

Absolutely, when formulas and data are verified carefully.

Download & Prepare Form 16 Part A and B in Excel for 50 Employees (FY 2025-26)

Key Features:

- Firstly, this Excel-based system allows you to download Form 16 Part A directly from TRACES and organise it employee-wise without confusion. As a result, employer and employee details remain accurate and compliant.

- Secondly, you can prepare Form 16 Part B automatically in Excel, which means salary breakup, exemptions, deductions, and tax calculations update instantly when you enter data.

- Moreover, the Excel format supports bulk preparation for up to 50 employees at one time. Therefore, you save hours compared to preparing forms individually.

- Additionally, built-in formulas auto-calculate taxable income, rebate, cess, and net tax payable. Consequently, the risk of manual calculation errors reduces significantly.

- Furthermore, the file enables easy old vs new tax regime comparison. Hence, you can choose the most beneficial option for each employee.

- In addition, you can edit employee details quickly, and at the same time, Excel updates all related calculations automatically.

- Meanwhile, the structured layout ensures that Part A and Part B remain perfectly matched, so discrepancies never arise during verification.

- Likewise, the Excel tool allows easy reconciliation with Form 26Q, which helps you stay compliant with income tax rules.

- As a result, you can generate print-ready Form 16 PDFs for all employees smoothly and without formatting issues.

- Most importantly, this Excel-based solution is user-friendly, so even beginners can prepare Form 16 confidently without professional software.

- Finally, by using Excel automation, you meet statutory deadlines comfortably, reduce stress, and improve overall payroll efficiency for FY 2025-26.