Preparing Form 16 every year can feel like standing in a long queue that never moves. However, things change when automation enters the picture. Download Automatic Master of Form 16 in Excel FY 2025-26 and see how tax compliance becomes smooth, fast, and stress-free. Above all, instead of preparing Form 16 one by one, you can now generate 50 employees’ Form 16 at a time, which saves hours of manual effort. Moreover, this Excel-based solution works perfectly for both small offices and large organisations. So, why struggle with repetitive work when a smart tool can do it for you?

Table of Contents

| Sr# | Headings |

| 1 | Introduction to Automatic Master of Form 16 |

| 2 | What is Form 16 and Why It Matters |

| 3 | Challenges of Manual Form 16 Preparation |

| 4 | Why Choose Excel-Based Automation |

| 5 | after all, Key Features of Automatic Master of Form 16 |

| 6 | Prepare 50 Employees Form 16 at One Time |

| 7 | Accuracy and Compliance for FY 2025-26 |

| 8 | Time-Saving Benefits for Employers |

| 9 | User-Friendly Design for the General Public |

| 10 | Who Can Use This Excel Utility |

| 11 | Step-by-Step Working Overview |

| 12 | after that, Benefits for Accountants and Offices |

| 13 | Data Security and Error Reduction |

| 14 | Comparison with Traditional Methods |

| 15 | Final Thoughts and Conclusion |

1. Introduction to Automatic Master of Form 16

To begin with, Download Automatic Master of Form 16 in Excel FY 2025-26 gives you a single file that manages multiple employees effortlessly. Instead of juggling several sheets, you work on one master file. Consequently, everything stays organised and easy to track.

2. What is Form 16 and Why It Matters

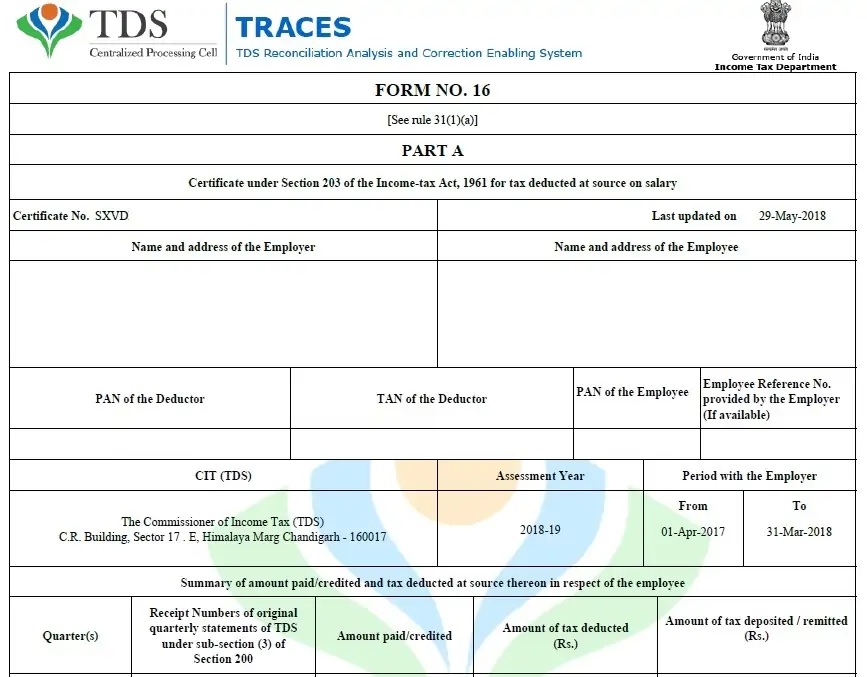

Form 16 is more than just a tax document. In fact, it acts like a report card for salaried employees. It shows salary details, deductions, and TDS. Therefore, timely and correct preparation becomes essential for both employers and employees.

3. Challenges of Manual Form 16 Preparation

Also, manually preparing Form 16 often leads to mistakes. For example, calculation errors, missing data, or formatting issues can occur. Moreover, when handling many employees, the workload increases rapidly. As a result, stress and delays become common.

4. Why Choose Excel-Based Automation

Excel automation works like a calculator that never gets tired. Since Excel is familiar to most users, learning becomes easy. Additionally, formulas handle calculations automatically. Thus, accuracy improves while effort reduces.

5. Key Features of Automatic Master of Form 16

Some standout features include:

- Automatic calculations

- Built-in compliance for FY 2025-26

- Single master database

- Print-ready Form 16 format

Because of these features, the tool feels reliable and practical.

6. Prepare Form 16 for 50 Employees at One Time

Firstly, bulk preparation stands out as one of the strongest advantages of this Excel utility. Previously, employers prepared Form 16 one employee at a time. Now, you generate Form 16 for 50 employees simultaneously. As a result, the system speeds up the entire process. Consequently, tasks that once consumed several days finish within minutes. In short, this feature dramatically boosts efficiency. More importantly, it removes repetitive manual work. Thus, organisations experience smoother payroll compliance.

7. Accuracy and Compliance for FY 2025-26

Undoubtedly, accuracy plays a critical role in tax documentation. Therefore, this Excel utility strictly follows the latest Income Tax Rules for FY 2025-26. In addition, it applies updated slabs, deductions, and exemptions correctly. As a consequence, calculation errors are reduced significantly. Moreover, compliance improves automatically. Likewise, employers gain peace of mind. Eventually, correct reporting minimises the risk of notices. Hence, users trust the output with confidence.

8. Time-Saving Benefits for Employers

Clearly, time saved equals productivity gained. Since this utility automates calculations and formats, employers avoid manual effort. Meanwhile, payroll teams focus on more important responsibilities. Furthermore, the system handles repetitive tasks effortlessly. As a result, deadlines feel manageable. Similarly, stress levels decrease. In effect, employers complete tax-related work faster. Ultimately, organisations operate more efficiently.

9. User-Friendly Design for the General Public

Notably, the design remains simple and intuitive. Even so, it delivers powerful functionality. If you lack tax expertise, you can still use the utility confidently. In other words, the process feels straightforward. Likewise, the clear layout guides users step by step. Thus, learning time stays minimal. Consequently, beginners and professionals feel equally comfortable. Overall, usability remains a key strength.

10. Who Can Use This Excel Utility

Specifically, this Excel utility serves a wide audience. For example, small business owners rely on it for payroll compliance. Similarly, accountants use it for multiple clients. At the same time, HR departments benefit from bulk processing. Additionally, tax consultants appreciate its accuracy. Therefore, the tool adapts to different needs. In conclusion, it fits diverse professional environments without complications.

11. Step-by-Step Working Overview

Initially, you enter employee details. Next, you input salary components and deduction data. After that, the Excel utility calculates tax automatically. Subsequently, the system prepares Form 16 Part A and Part B. Finally, you print or save the forms instantly. Thus, the workflow remains smooth. Meanwhile, automation handles the complexity. As expected, results appear quickly and accurately.

12. Benefits for Accountants and Offices

Generally, accountants manage multiple clients and tight schedules. Hence, automation becomes essential. By using this Excel utility, accountants reduce repetitive work. Moreover, productivity increases significantly. At the same time, errors decrease. Accordingly, client satisfaction improves. In practice, offices complete more work in less time. Ultimately, professionals gain a competitive edge.

13. Data Security and Error Reduction

Importantly, the utility stores all data in a single Excel file. Because of this, tracking records becomes easier. Also, fewer manual entries reduce mistakes. As a result, accuracy improves. Meanwhile, offline usage enhances security. Consequently, sensitive employee data remains protected. Thus, users feel confident about data safety. In summary, reliability stays high.

14. Comparison with Traditional Methods

Traditionally, employers prepared Form 16 manually. By contrast, this Excel utility automates the process. On the one hand, manual methods consume time. On the other hand, automation delivers speed and precision. Likewise, formatting remains consistent. Therefore, the difference feels obvious. Simply put, it resembles sending an email instead of writing letters by hand. Hence, efficiency improves dramatically.

15. Final Thoughts and Conclusion

To sum up, downloading the Automatic Master of Form 16 in Excel for FY 2025-26 offers a smart and modern solution. Overall, it saves time, improves accuracy, and simplifies bulk processing. In addition, it enhances compliance and usability. Consequently, tax preparation becomes stress-free. Ultimately, this utility transforms a complex responsibility into a smooth, reliable experience.

FAQs

Firstly, can you prepare Form 16 for 50 employees at one time?

Yes, the master Excel file supports bulk preparation for up to 50 employees simultaneously.

Secondly, does the tool comply with FY 2025-26 rules?

Absolutely, it follows the latest Income Tax regulations applicable for FY 2025-26.

Thirdly, do you need advanced Excel knowledge?

No, basic Excel skills are sufficient to use this utility comfortably.

Fourthly, is data safe in this Excel-based system?

Yes, because it works offline, your data remains secure.

Finally, who benefits the most from this utility?

Clearly, employers, accountants, HR professionals, and tax consultants gain the maximum benefit.

In conclusion, if you want to simplify tax compliance, reduce errors, and save valuable time, Download Automatic Master of Form 16 in Excel FY 2025-26 today and experience the difference.

Download the Automatic Income Tax Master of Form 16 Part A and Part B in Excel, which allows you to prepare Form 16 for up to 50 employees at a time for FY 2025-26 and AY 2026-27.

Features of This Excel Utility

- Firstly, this Excel utility prepares Form 16 Part A and Part B for 50 employees simultaneously for the FY 2025-26.

- Secondly, this Excel utility automatically calculates income tax liabilities according to the latest Income Tax Slabs under both the New and Old Tax Regimes.

- Thirdly, this Excel utility provides a unique salary structure for individuals, strictly aligned with the Budget 2025 provisions.

- Fourthly, this Excel utility includes all amended Income Tax sections as updated in Budget 2025 under both tax regimes.

- Additionally, this Excel utility prevents duplicate or double PAN entries, ensuring error-free employee name and PAN data management.

- Moreover, this Excel utility enables seamless printing of Form 16 Part A and Part B on A4-size paper.

- Furthermore, this Excel utility automatically converts amounts into words without using any Excel formulas.

- Likewise, both Government and Non-Government organizations can easily use this Excel utility.

- Meanwhile, this Excel utility works as a simple Excel file—just download it, enter data in the input sheet, and it instantly generates Form 16 Part A & B for 50 employees.

- Finally, you can save employee data securely on your system, and the utility runs smoothly on MS Office 2003, 2007, 2010, and 2011.