The 8th Pay Commission Arrears Calculation of C.G.Employees: With Automatic Arrears Relief Calculator U/s 89(1) with Form 10E FY 2025-26 has become one of the most discussed topics among Central Government employees. After all, arrears are not just numbers; they represent delayed earnings, future security, and long-awaited financial relief. So, how do you calculate these arrears correctly? More importantly, how do you save tax on them legally? Let’s break it down step by step, just like opening a locked savings box with the right key 🔑.

Table of Contents

| Sr# | Headings |

| 1 | Overview of the 8th Pay Commission |

| 2 | Who Are Eligible C.G. Employees |

| 3 | What Are Pay Commission Arrears |

| 4 | Why Arrears Calculation Is Important |

| 5 | Components of 8th Pay Commission Arrears |

| 6 | Challenges in Manual Arrears Calculation |

| 7 | Role of Automatic Arrears Calculator |

| 8 | Understanding Section 89(1) Relief |

| 9 | Importance of Form 10E |

| 10 | How the Automatic Calculator Applies Form 10E |

| 11 | Tax Impact of Arrears Without Relief |

| 12 | Benefits of Excel-Based Arrears Calculator |

| 13 | Common Mistakes to Avoid |

| 14 | Practical Example of Arrears Calculation |

| 15 | Why FY 2025-26 Is Crucial |

1. Overview of the 8th Pay Commission

Firstly, the 8th Pay Commission revises the salary structure of Central Government employees. Moreover, it actively restructures basic pay, allowances, and pension benefits. Additionally, it aligns salaries with current economic conditions. However, when authorities delay implementation, arrears automatically accumulate. Therefore, employees start receiving pending salary differences. Consequently, understanding arrears becomes extremely important. Furthermore, proper awareness helps employees plan their finances better. Ultimately, timely knowledge prevents confusion and financial stress.

2. Who Are Eligible C.G. Employees

Firstly, all Central Government employees qualify under the 8th Pay Commission. Additionally, defence personnel also come under its scope. Moreover, pensioners benefit from revised pension structures. Furthermore, employees who served during the applicable period remain eligible. Hence, eligibility depends on service tenure. In contrast, the current posting does not affect eligibility. Therefore, past service plays a crucial role. As a result, many retired employees also receive arrears.

3. What Are Pay Commission Arrears

Simply put, pay commission arrears represent backdated salary differences. In other words, employees receive unpaid salary portions later. Similarly, arrears function like overdue payments. Moreover, they accumulate when revised pay applies retrospectively. Therefore, employees receive lump-sum payments. Consequently, arrears must be calculated accurately. Otherwise, mistakes can occur.

4. Why Arrears Calculation Is Important

Firstly, correct arrears calculation ensures accurate payment. Moreover, it prevents short or excess payment. Additionally, it avoids unnecessary tax deductions. Therefore, employees protect their income. Consequently, correct computation brings peace of mind. Furthermore, accurate figures help in tax planning. Ultimately, precision saves both money and time.

5. Components of 8th Pay Commission Arrears

Primarily, arrears include multiple components. Firstly, they include Basic Pay Difference. Secondly, they cover Dearness Allowance arrears. Moreover, they add HRA and other allowances. Additionally, revised pension, if applicable, forms part of arrears. Therefore, all these components combine. Consequently, they form the total arrears amount payable.

6. Challenges in Manual Arrears Calculation

Manual calculation often creates problems. Firstly, it increases the risk of errors. Moreover, it consumes valuable time. Additionally, it creates unnecessary stress. Consequently, employees may face incorrect tax liabilities. Furthermore, manual methods lack accuracy. Therefore, employees should avoid them whenever possible.

7. Role of Automatic Arrears Calculator

An Automatic Arrears Calculator simplifies the entire process. Firstly, it calculates arrears instantly. Moreover, it applies tax relief correctly. Additionally, it reduces human error. Therefore, it ensures accuracy. Consequently, it works like a perfect digital assistant. In short, it never makes arithmetic mistakes.

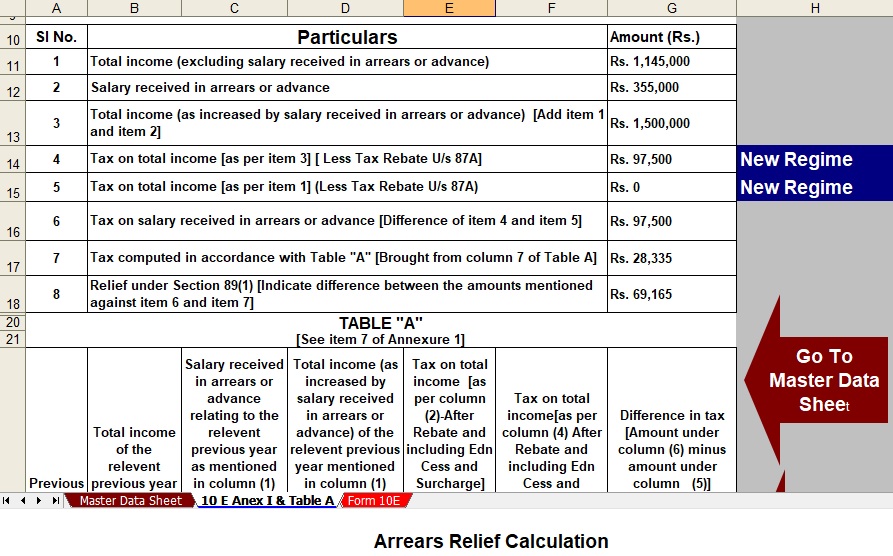

8. Understanding Section 89(1) Relief

Section 89(1) provides tax relief on arrears. Essentially, it spreads income over previous years. Moreover, it recalculates tax year-wise. Consequently, it reduces the tax burden significantly. Therefore, employees save tax legally. Additionally, it prevents income from falling into higher slabs.

9. Importance of Form 10E

Form 10E plays a vital role in claiming relief. Firstly, employees must submit it compulsorily. Moreover, without Form 10E, the Income Tax Department rejects relief claims. Therefore, filing Form 10E becomes mandatory. Consequently, it ensures compliance. Ultimately, it safeguards tax benefits.

10. How the Automatic Calculator Applies Form 10E

Modern calculators automatically generate Form 10E data. Moreover, they compute year-wise income accurately. Additionally, they calculate relief instantly. Therefore, compliance becomes simple. Consequently, employees file returns stress-free. In short, automation removes complexity.

11. Tax Impact of Arrears Without Relief

Without tax relief, arrears increase taxable income sharply. Consequently, employees may enter higher tax slabs. Moreover, tax liability rises suddenly. However, Section 89(1) prevents this issue. Therefore, claiming relief becomes essential. Ultimately, it ensures fair taxation.

12. Benefits of Excel-Based Arrears Calculator

An Excel-based arrears calculator offers multiple advantages. Firstly, it saves time. Secondly, it reduces errors. Moreover, it auto-calculates relief. Additionally, it generates Form 10E. Therefore, it acts like a financial assistant. Consequently, it simplifies tax planning.

13. Common Mistakes to Avoid

Employees must avoid common errors. Firstly, never skip Form 10E. Secondly, avoid incorrect year-wise breakup. Moreover, do not rely on manual tax calculation. Additionally, never ignore Section 89(1). Otherwise, employees may lose rightful tax benefits. Therefore, caution is necessary.

14. Practical Example of Arrears Calculation

Suppose arrears amount to ₹3,00,000 over three years. Firstly, the calculator distributes income year-wise. Then, it recalculates tax for each year. Moreover, it compares old and revised tax. Finally, it computes relief. Therefore, the process becomes simple and transparent.

15. Why FY 2025-26 Is Crucial

FY 2025-26 holds special importance. Firstly, revised tax regimes apply. Moreover, timely relief filing ensures smooth return processing. Therefore, proper planning becomes essential. Consequently, employees must act carefully this year.

Conclusion

In conclusion, the 8th Pay Commission Arrears Calculation of C.G.Employees: With Automatic Arrears Relief Calculator U/s 89(1) with Form 10E FY 2025-26 becomes easy when done correctly. With the right tools, employees calculate arrears accurately, claim relief efficiently, and save tax legally. Think of it like using GPS instead of guessing roads—ultimately, you reach your destination faster, safer, and stress-free.

FAQs

1. What is the 8th Pay Commission arrears calculation?

It calculates salary differences between old and revised pay for eligible periods.

2. Is Section 89(1) relief mandatory for arrears?

Yes, if you want to reduce tax liability, Section 89(1) relief is essential.

3. Why is Form 10E required?

Form 10E is mandatory to claim tax relief on arrears under Section 89(1).

4. Can I calculate arrears manually?

Yes, but manual calculation is time-consuming and error-prone.

5. Is an Excel arrears calculator reliable?

Yes, when designed properly, it ensures accuracy, compliance, and tax savings.

Download Automatic Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26 as per Budget 2025

Download Automatic Income Tax Form 10E in Excel from 2000-01 to FY 2025-26