Income tax often feels like a complicated maze, doesn’t it? However, once you understand the basics, everything becomes clearer. In fact, this Complete Guide to Income Tax for FY 2025-26 explains income tax in India using simple language, real-life examples, and practical tips. Whether you are a salaried employee, a pensioner, or a freelancer, this guide helps you calculate tax confidently. Think of income tax like a yearly health check-up for your finances—slightly uncomfortable at first, but extremely useful in the long run.

Table of Contents

| Sr# | Headings |

| 1 | What Is Income Tax in India? |

| 2 | Why Income Tax Matters for Citizens |

| 3 | Financial Year vs Assessment Year |

| 4 | Types of Income Covered |

| 5 | Income Tax Slabs for FY 2025-26 |

| 6 | Old Tax Regime Explained |

| 7 | New Tax Regime Explained |

| 8 | Deductions and Exemptions |

| 9 | Section 80C and Other Key Sections |

| 10 | Standard Deduction for Salaried Persons |

| 11 | How to Calculate Income Tax (Step-by-Step) |

| 12 | Income Tax Calculator Benefits |

| 13 | Advance Tax and TDS Basics |

| 14 | Filing Income Tax Return (ITR) |

| 15 | Common Income Tax Mistakes |

1. What Is Income Tax in India?

Income tax is the amount you pay to the government on your earnings. Simply put, if you earn money, you share a portion with the nation. Moreover, the government uses this money for roads, healthcare, education, and national development.

2. Why Income Tax Matters for Citizens

Income tax matters because it supports public services. Additionally, filing returns helps you get loans easily, claim refunds, and stay legally compliant. Therefore, paying tax on time builds financial credibility.

3. Financial Year vs Assessment Year

The Financial Year (FY) 2025-26 runs from 1 April 2025 to 31 March 2026. Meanwhile, the Assessment Year (AY) 2026-27 is when you file your return. Thus, income earned now gets assessed later.

4. Types of Income Covered

Income tax applies to five main heads. Firstly, salary income includes wages and a pension. Secondly, house property income covers rental earnings. Thirdly, business or professional income applies to self-employed persons. Fourthly, capital gains arise from selling assets. Finally, other sources include interest and dividends.

5. Income Tax Slabs for FY 2025-26

Tax slabs decide how much tax you pay. Interestingly, India offers two regimes. Consequently, you can choose what suits you best.

6. Old Tax Regime Explained

The old regime allows multiple deductions and exemptions. For example, you can claim Section 80C, HRA, and medical insurance. Therefore, this regime suits people with investments and savings.

7. New Tax Regime Explained

The new regime offers lower tax rates but fewer deductions. Hence, it works well for people who prefer simplicity. However, you must compare both regimes before choosing.

8. Deductions and Exemptions

Deductions reduce taxable income. For instance, exemptions like HRA lower salary tax. Similarly, deductions like 80C reduce overall liability. As a result, smart planning saves money.

9. Section 80C and Other Key Sections

Section 80C allows deductions up to ₹1.5 lakh. Additionally, Section 80D covers medical insurance. Furthermore, Section 80CCD(1B) offers extra NPS benefits. Therefore, these sections play a vital role.

10. Standard Deduction for Salaried Persons

Salaried employees get a standard deduction. As a result, taxable salary decreases automatically. This benefit applies under both regimes, making tax simpler.

11. How to Calculate Income Tax (Step-by-Step)

Firstly, calculate total income. Secondly, subtract exemptions. Thirdly, apply deductions. Then, choose the tax regime. Finally, apply slab rates and add cess. Consequently, you get the final tax payable.

12. Income Tax Calculator Benefits

An income tax calculator saves time. Moreover, it avoids manual errors. Additionally, it compares old and new regimes instantly. Therefore, calculators act like GPS for your tax journey.

13. Advance Tax and TDS Basics

TDS deducts tax at source. Meanwhile, advance tax applies to self-employed individuals. Hence, paying tax throughout the year avoids penalties.

14. Filing Income Tax Return (ITR)

Filing ITR is mandatory for many taxpayers. Moreover, online filing makes it easy. Therefore, always file before the due date to avoid fines.

15. Common Income Tax Mistakes

People often forget deductions, choose the wrong regime, or miss deadlines. However, careful planning prevents these errors. Thus, staying informed helps immensely.

Conclusion

This Complete Guide to Income Tax for FY 2025-26 shows that income tax is not scary. Instead, it becomes manageable with the right knowledge. By understanding slabs, deductions, and calculators, you gain control over your finances. Ultimately, informed taxpayers save more and stress less.

Frequently Asked Questions (FAQs)

- What is the best tax regime for FY 2025-26?

The best regime depends on your deductions and income structure. - Is filing ITR mandatory for everyone?

No, but it is mandatory if income exceeds the basic exemption limit. - Can I change my tax regime every year?

Yes, salaried individuals can choose each year. - Are income tax calculators accurate?

Yes, if you enter correct data, calculators provide reliable estimates. - What happens if I miss the ITR deadline?

You may face penalties, interest, and delayed refunds.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Firstly, Dual Tax Regime Selection (Section 115BAC):

You can easily select either the New Tax Regime or the Old Tax Regime under Section 115BAC. Moreover, the software actively compares both regimes side by side. As a result, you instantly identify the option that offers maximum tax savings. - Secondly, Customised Salary Structure Support:

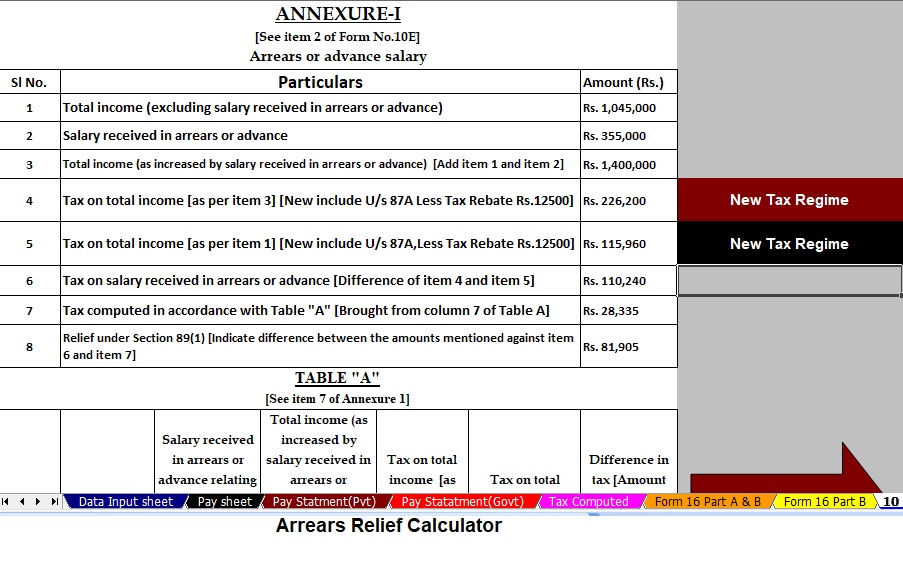

The utility automatically adapts to your salary structure, whether you work in a Government or Non-Government organisation. Additionally, it minimises manual data entry. Consequently, you save time while reducing calculation errors. - Thirdly, Automatic Arrears Relief Calculator (Section 89(1) with Form 10E):

The software precisely calculates income tax arrears relief from FY 2000-01 to 2025-26. Furthermore, it automatically generates Form 10E. Therefore, you ensure accurate relief claims without complex calculations. - Fourthly, Updated and Revised Form 16 Generation:

The Excel utility automatically prepares Revised Form 16 (Part A & B and Part B) for FY 2025-26. Likewise, it keeps the format fully updated. Hence, your tax documents remain compliant with the latest income tax rules. - Finally, Simplified and Error-Free Compliance:

The software uses advanced built-in formulas to calculate tax quickly and accurately. In addition, it eliminates manual intervention. As a result, you complete income tax preparation with confidence, speed, and zero errors.