The New Tax Regime is becoming the central tax structure in Budget 2025. The government confirmed that nearly 80% of taxpayers have already shifted to the new system because it offers simpler slabs, lower tax rates, and a hassle-free filing experience. While the old tax regime provided many deductions, many taxpayers avoided the complex documentation. Now, the government plans to push the old regime toward a complete shift, allowing people to enjoy tax clarity.

Before we move deeper, I will ask a quick question. If most people have already shifted, then doesn’t it make sense to fully simplify tax laws? Just like replacing multiple remote controls with one smart device, a single structured tax system can, therefore, reduce confusion. Moreover, taxpayers can, consequently, understand the rules faster. Furthermore, authorities can, additionally, audit returns easily. Ultimately, everyone benefits.

To support this transition, several tools now appear in the market. One of the most practical solutions today introduces an Automatic Income Tax Software All-in-One in Excel, designed specifically for FY 2025–26. The tool helps taxpayers calculate tax liability instantly, compare both regimes quickly, and prepare reports efficiently—all in one sheet. Additionally, the software reduces errors. Similarly, it assists salaried individuals during filing. Meanwhile, users save time. Finally, taxpayers gain confidence.

Table of Contents

Sr# | Headings

1 | Introduction

2 | Why Budget 2025 Focuses on a New Tax Regime

3 | What Makes the New Tax Regime Attractive?

4 | Comparison With Old Tax Regime

5 | Lower Tax Rates Explained

6 | Standard Deduction Benefits

7 | Why 80% Taxpayers Have Already Shifted

8 | Role of Automatic Income Tax Software

9 | Features of All-in-One Excel Tool

10 | How the Software Helps the Salaried Class

11 | Impact on Middle-Class Families

12 | Expected Changes in Budget 2025

13 | Pros and Cons of the New Regime

14 | Why a Single Tax Regime Helps Everyone

15 | Conclusion

Introduction

People usually feel stressed during tax season; however, they prefer simple solutions. The New Tax Regime, therefore, removes stress by offering a straightforward structure that simplifies calculations. Moreover, the regime works better when taxpayers use a digital tool. Consequently, they file returns confidently. Lastly, they reduce dependency on paperwork.

Why Budget 2025 Focuses on the New Tax Regime

Budget 2025 promotes a smooth transition. First, the presentation highlights uniformity. Second, the government aims to modernise compliance. Third, transition words like further, moreover, and additionally demonstrate continuous progress. Consequently, policymakers intend to foster a unified system. Eventually, taxpayers will adjust easily.

What Makes the New Tax Regime Attractive?

First, the regime offers lower slab rates. Second, it reduces the dependency on endless deduction claims. Third, it supports digital filing. Moreover, taxpayers use a clean system. Furthermore, they save time. Additionally, they avoid confusion. Finally, they enjoy transparency.

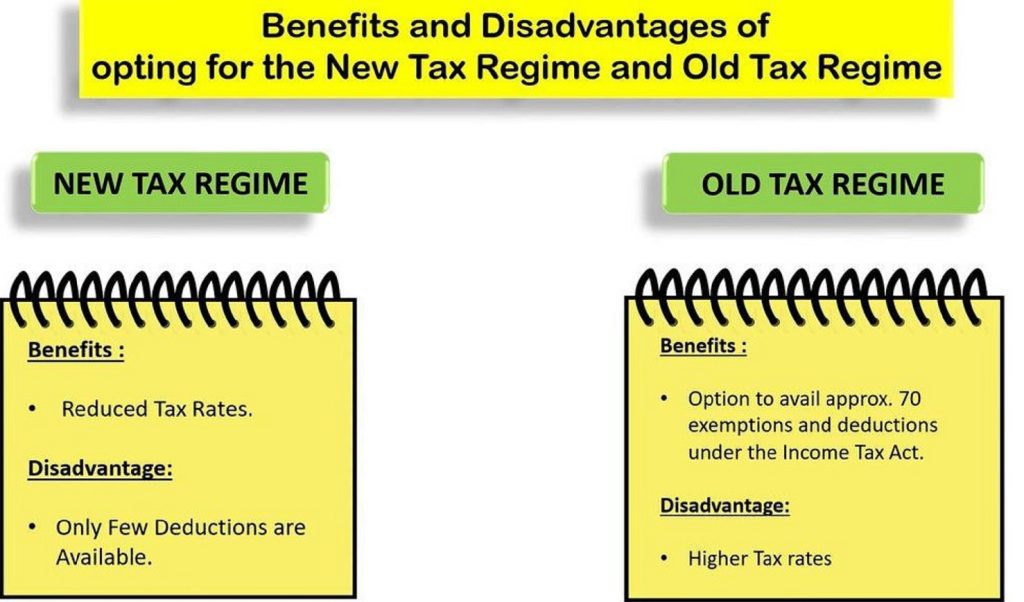

Comparison With the Old Tax Regime

The old system offered numerous deductions; however, the new regime eliminates unnecessary forms. Although some individuals still prefer deductions due to housing loans or investments, many taxpayers, ultimately, choose simplicity. Meanwhile, the new approach reduces documentation. Consequently, returns become seamless.

Lower Tax Rates Explained

The new slabs provide progressive benefits. As income increases, taxpayers still enjoy reasonable relief. Moreover, the government encourages voluntary savings instead of forcing investments through deductions. Additionally, citizens gain flexibility. Furthermore, they choose financial instruments wisely. Eventually, planning becomes smarter.

Standard Deduction Benefits

Earlier, the regime lacked deductions; however, Budget 2024 reintroduced the standard deduction. Now, taxpayers receive relief without paperwork. Moreover, they claim this benefit automatically. Additionally, the process remains simple. Therefore, the regime becomes attractive. Ultimately, users accept it quickly.

Why 80% Taxpayers Have Already Shifted

Interestingly, many salaried individuals realised that reduced tax rates worked better than documenting proofs. Therefore, the shift happened naturally. Moreover, HR departments advised the transition. Additionally, financial advisors recommended the move. Consequently, adoption increased rapidly. Finally, the majority embraced the change.

Role of Automatic Income Tax Software

An Automatic Income Tax Software All-in-One in Excel for FY 2025–26 simplifies calculations. Moreover, it instantly compares the old and new systems. Furthermore, it highlights tax savings. Additionally, it auto-generates forms. Consequently, users reduce effort. Ultimately, filing becomes smoother.

Features of All-in-One Excel Tool

The tool includes auto tax calculation, Form 10E preparation, arrears calculation, and investment summaries. Additionally, it supports multiple salary structures. Moreover, it provides downloadable reports. Furthermore, it updates slabs. Similarly, it prints tax summaries. Therefore, professionals trust the tool.

How the Software Helps the Salaried Class

Most salaried taxpayers do not know the exact tax amount until the financial year ends. The Excel tool, however, shows real-time liability. Moreover, users see monthly TDS impacts. Additionally, they adjust investments accordingly. Consequently, planning becomes accurate. Ultimately, tax filing stays stress-free.

Impact on Middle-Class Families

The New Tax Regime boosts household savings because families avoid putting money into schemes forcefully only for deductions. Instead, they choose investments wisely. Moreover, they plan based on goals. Additionally, they avoid lock-ins. Therefore, money moves freely. Ultimately, middle-class finances improve.

Expected Changes in Budget 2025

Experts expect that the old regime may remain optional for one more year before a full phase-out. However, taxpayers will adapt smoothly. Moreover, the government may add minor benefits. Additionally, authorities might simplify forms. Consequently, the transition will accelerate. Lastly, clarity will improve.

Pros and Cons of the New Regime

Every policy carries positive and negative sides. Although the new regime remains simpler, individuals using heavy deductions may feel the change. However, overall benefits remain strong. Moreover, transparency increases. Additionally, returns reduce errors. Therefore, adoption rises. Ultimately, most taxpayers support it.

Why a Single Tax Regime Helps Everyone

A movement toward a single tax system works like shifting from a busy road to a highway—it reduces chaos. Moreover, it streamlines compliance. Additionally, it supports digital governance. Therefore, taxpayers enjoy transparency. Ultimately, the entire ecosystem grows.

Conclusion

In conclusion, Budget 2025 reflects a major policy shift. Since 80% of taxpayers have already moved, making the New Tax Regime the main structure appears logical. Moreover, Automatic Income Tax Software allows anyone to calculate tax effectively. Furthermore, the new regime simplifies filing. Therefore, it shapes India’s digital tax future. Ultimately, taxpayers gain clarity, convenience, and confidence.

FAQs

1. What is the main reason for shifting to the New Tax Regime?

The main reason involves simplicity and lower tax rates. Moreover, it reduces paperwork and offers clean slabs.

2. Does the New Tax Regime allow deductions?

Yes, the regime offers a standard deduction and certain limited benefits. However, it removes many traditional deductions.

3. Why did 80% taxpayers already shift to the New Regime?

Because they realised that lower tax rates worked better than claiming multiple deductions with paperwork.

4. Is the old tax regime still available in FY 2025–26?

Yes, it remains optional. However, Budget 2025 may introduce changes to phase it out.

5. How does Automatic Tax Software help under the New Tax Regime?

It calculates tax instantly, compares regimes, generates reports, and saves time for salaried taxpayers.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can effortlessly choose between the New or Old Tax Regime under Section 115BAC. Furthermore, the tool automatically compares both regimes to help you identify the most tax-saving option. - Customised Salary Structure:

It automatically adjusts according to your salary format, whether you belong to a Non-Government organisation. Additionally, this customisation reduces manual entry and saves valuable time. - Automatic filled up Form 12 BA.

- Updated Form 16 (Part A & B and Part B):

This tool automatically generates Revised Form 16 (Part A & B and Part B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest tax formats. - Simplified Compliance:

It ensures quick and error-free tax computation through advanced built-in formulas. Furthermore, you can confidently prepare your return with zero manual intervention, enhancing both speed and accuracy.