Preparing Form 16 Part B for a large workforce demands efficiency and unwavering accuracy. When you manage a payroll of 50 employees or more, relying on manual calculations becomes impractical; consequently, you must master a robust, automated Excel utility. This process allows you to efficiently meet your compliance obligations for the Financial Year 2025-26 (Assessment Year 2026-27). Therefore, adopt a systematic approach to tackle this high-volume task. Furthermore, this active process ensures every employee receives their legally mandated certificate detailing their income, deductions, and tax liability. Phase I: Establishing the Master Data Hub

Successfully generating 50 individual certificates first requires constructing a single, authoritative master sheet in Excel. Specifically, this sheet acts as your central database, feeding critical information into the individual Form 16 Part B templates.

To begin, establish key columns in your master sheet. You must meticulously record the static employee details: name, designation, and Permanent Account Number (PAN). Next, you enter the dynamic financial data, which forms the core of the Part B computation. Importantly, this data includes the monthly breakup of Gross Salary, Perquisites, and Profits in lieu of Salary, as defined under Section 17(1), 17(2), and 17(3) of the Income Tax Act.

However, you cannot forget a critical component: the Tax Deducted at Source (TDS) and deposit details, which you must obtain from Part A of Form 16, which the TRACES portal generates. Generally, you download this consolidated Part A data; subsequently, you link the relevant columns back into your Part B master file. Indeed, precision at this initial stage prevents errors from propagating throughout the entire set of 50 forms. Phase II: Automating Exemptions and Allowances (Section 10)

Form 16 Part B mandates a detailed breakup of allowances and the total amount of exemptions claimed under various clauses of Section 10. Consequently, you must design your Excel template to calculate these exemptions automatically.

For instance, the most common exemption, House Rent Allowance (HRA), necessitates a complex calculation involving the actual HRA received, rent paid less 10% of salary, and 50% (or 40%) of the basic salary. Thus, you implement an IF and MIN function-based formula within your master sheet for each employee. Similarly, you apply specific calculations for other Section 10 allowances, such as Leave Travel Concession (LTC) or other prescribed allowances. Ultimately, the Excel sheet must compute the exact taxable portion of these components.

Furthermore, you must ensure the employee furnishes the necessary declarations and proofs to substantiate all claimed exemptions. In this way, you validate the data before the final calculation. Afterwards, the system automatically subtracts the total exempted amount from the gross salary to arrive at the ‘Amount of salary received from current employer’.Phase III: Integrating Statutory Deductions (Section 16)

The next step involves applying statutory deductions under Section 16, a comparatively straightforward process. Specifically, you allocate a column for each of the three sub-sections.

First, you claim the Standard Deduction under Section 16(ia). For FY 2025-26, this amount stands at ₹50,000 for those opting for the Old Regime. Conversely, for those in the New Regime (the default regime for this financial year), the standard deduction is also available. Therefore, the Excel formula must incorporate a logic check to apply the correct amount based on the employee’s chosen tax regime.

Second, you factor in the Entertainment Allowance under Section 16(ii). However, this deduction applies almost exclusively to government employees; therefore, you only consider it if applicable. Third, you deduct the Tax on Employment (Professional Tax) under Section 16(iii). As a result, the total of these three deductions reduces the net salary, giving you the ‘Income chargeable under the head Salaries’.Phase IV: Handling Other Income and Chapter VI A Deductions

Once you establish the salary income, you must account for any ‘Other Income’ the employee reports. Namely, this could include interest from fixed deposits or income from house property. Consequently, you create a separate input area in your master sheet where employees can declare this income using Form 12BB. Then, your utility incorporates this declared income to determine the employee’s total gross income.

Subsequently, you move on to the highly complex Section 80 deductions, which fall under Chapter VI A. For example, Section 80C covers investments like Public Provident Fund (PPF), Life Insurance Premium (LIC), and home loan principal repayment, with a maximum limit. Moreover, you include deductions for health insurance premiums (80D), interest on education loans (80E), and interest on electric vehicle loans (80EEB).

Crucially, your Excel model must validate all these claimed deductions against the prescribed limits for the FY 2025-26. First, of course, you gather the investment proof from all 50 employees. Second, you cross-verify each employee’s investment against the statutory caps. Third, you apply the correct logic to calculate the final deductible amount. Finally, subtracting the total Chapter VI A deductions from the gross income provides the total taxable income. Phase V: Final Tax Calculation and Form Generation

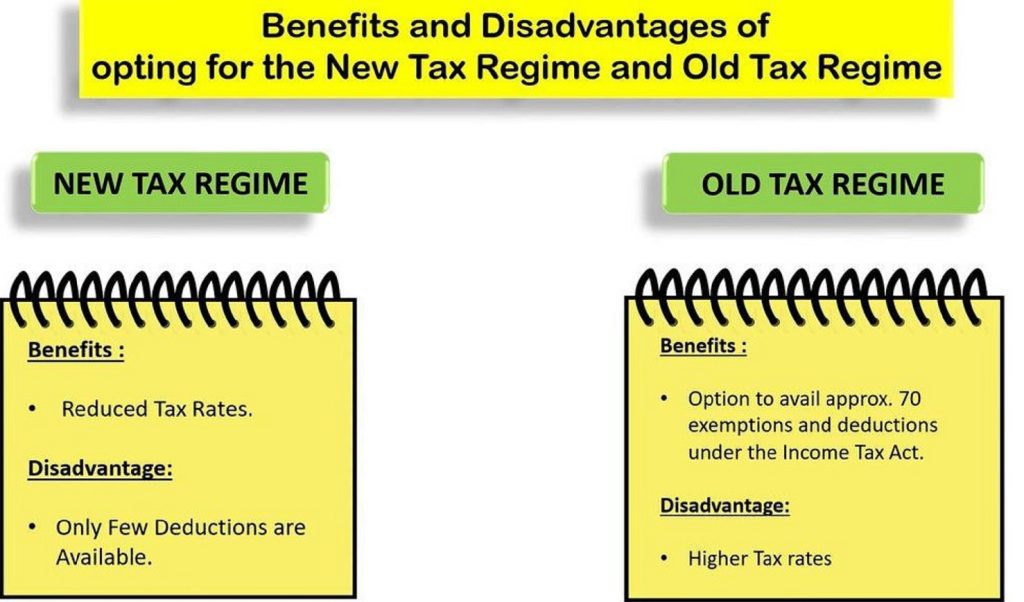

The ultimate phase involves the final tax computation and Form 16 Part B generation. First, your Excel logic must calculate the total tax liability on the ‘Total Taxable Income’ using the applicable slab rates for both the Old and New Tax Regimes (for FY 2025-26). Specifically, the sheet applies the lesser of the two regimes’ tax outgo, provided the employee made an active choice; otherwise, the New Regime automatically applies.

Next, you factor in any tax rebates, such as those under Section 87A, and finally add the Health and Education Cess. Furthermore, you adjust for any relief claimed under Section 89, particularly for salary arrears. At this point, the calculated tax matches the TDS deducted and reported in Part A.

Then, you use mail merge or a similar bulk-generation function within your Excel utility. Therefore, the master sheet information flows seamlessly into 50 separate, correctly formatted Part B annexures. Before concluding, you perform a final reconciliation: you compare the total tax liability with the total tax deposited for each employee. Only after the figures match, you sign and issue the 50 certificates.

To summarise, preparing Form 16 Part B for 50 employees in Excel is a rigorous yet manageable process. Ultimately, active, systematic data management and automated logic guarantee your compliance and deliver accurate tax certificates to your team. Indeed, a well-structured Excel utility transforms this annual compliance challenge into a streamlined operation

Download Automatic Form 16 Part A and B in Excel for Salaried Employees for FY 2025-26 & AY 2026-27

- Firstly, the Excel tool automatically prepares Form 16 Part B for up to 50 employees in one go, saving valuable time.

- Secondly, it accurately captures salary details, thereby reducing manual entry errors.

- Moreover, the sheet automatically calculates taxable income under the latest FY 2025-26 rules.

- Additionally, it applies the standard deduction correctly and thus ensures compliance.

- Furthermore, the software auto-computes deductions under Chapter VI-A and hence avoids calculation mistakes.

- Meanwhile, you can update employee data quickly without breaking formulas.

- As a result, bulk preparation becomes smooth, fast, and stress-free.

- Likewise, tax calculation updates instantly whenever you revise salary figures.

- Consequently, you generate accurate Form 16 Part B without repeated checks.

- In addition, the Excel format remains user-friendly and easy to understand.

- Similarly, it supports both Government and Non-Government employee data.

- On the other hand, it eliminates dependency on costly software tools.

- However, it still maintains professional accuracy and structured output.

- Therefore, employers can confidently issue Form 16 Part B on time.

- In fact, the sheet validates figures logically to prevent mismatches.

- Not only that, it also allows easy printing and PDF conversion.

- At the same time, you can prepare individual or bulk Form 16 Part B files.

- Eventually, this automation improves payroll efficiency significantly.

- Above all, the Excel tool follows income-tax compliance for FY 2025-26.

- Finally, it simplifies bulk Form 16 Part B preparation while ensuring accuracy, speed, and peace of mind.