Introduction

When it comes to filing your Income Tax, don’t you wish the entire process felt as effortless as arranging your daily planner? With the Automatic Income Tax Preparation Software All-in-One in Excel for Maharashtra State Government Employees for F.Y. 2025-26, that wish becomes a reality. This all-in-one Excel tool simplifies your tax calculations, automates tedious steps, and ensures accuracy—all while guiding you like a trusted colleague sitting beside you.

To help you understand everything clearly, this article breaks down every feature, benefit, and step in a smooth, conversational way. Let’s dive in and explore how this tool can transform your tax filing experience.

Table of Contents

| Sr# | Headings |

| 1 | Introduction |

| 2 | Understanding the Need for an Automatic Tax Software |

| 3 | Key Features of the All-in-One Excel Tax Software |

| 4 | Why Maharashtra State Government Employees Should Use It |

| 5 | How the Software Simplifies Income Tax Calculations |

| 6 | Step-by-Step Guide to Downloading the Software |

| 7 | Setting Up the Excel File |

| 8 | Entering Your Income Details Correctly |

| 9 | Choosing the Right Tax Regime in F.Y. 2025-26 |

| 10 | Automated Calculations and Deductions |

| 11 | How the Tool Prepares Form 16 and Other Reports |

| 12 | Tips to Avoid Common Tax Filing Mistakes |

| 13 | Benefits of Using an Excel-Based Tax System |

| 14 | Final Thoughts |

| 15 | FAQs |

1. Understanding the Need for an Automatic Tax Software

When you start filing your Income Tax, you often feel overwhelmed; however, you no longer need to struggle because an automatic tool can simplify everything instantly. Since government employees constantly juggle multiple allowances, deductions, and financial entries, you naturally look for a system that manages all these components effortlessly. Consequently, you benefit greatly when you use automatic Excel software because it reduces confusion, saves time, and ensures accuracy. Moreover, it prevents manual errors, and ultimately, it gives you complete clarity and confidence throughout your tax calculations.

2. Key Features of the All-in-One Excel Tax Software

A. Automatic Calculations

This tool automatically calculates taxable income, exemptions, and deductions; furthermore, it eliminates the need for manual formulas. As a result, you work faster, and additionally, you avoid calculation mistakes.

B. User-Friendly Interface

The software presents a clean, simple interface; therefore, beginners navigate it easily. Besides that, it guides you step-by-step so you never feel confused or lost.

C. Supports Old and New Tax Regimes

Because F.Y. 2025–26 includes both tax regimes, the tool instantly compares them for you. Consequently, you immediately see which option offers better savings.

D. Includes Form 10E, Form 16, and Other Sheets

Not only does the software generate all essential reports automatically, but it also prepares them with complete accuracy. Thus, you avoid manual data entry and, as a result, prevent formatting errors across all forms.

3. Why Maharashtra State Government Employees Should Use It

Maharashtra State Government employees follow unique pay structures; therefore, they require a tool specifically designed for their salary components. This Excel software correctly places every allowance, deduction, and pay element and consequently removes errors in the final Income Tax output. Additionally, it adjusts instantly to state-specific rules, ensuring accurate and reliable results every single time.

4. How the Software Simplifies Income Tax Calculations

Think of this tool as your personal tax assistant. Instead of shifting between calculators, websites, and documents, you simply enter your salary details. Immediately, the tool transitions smoothly through exemptions, deductions, tax slabs, and your final tax output. Moreover, it performs every calculation automatically and ultimately provides results that you can trust without hesitation.

5. Step-by-Step Guide to Downloading the Software

You can download the software easily by following these steps:

- First, visit the official download page.

- Next, click the Download Excel File

- Then, save the file to your preferred folder.

- Finally, enable editing and macros when prompted.

These steps ensure you activate all automation features effortlessly and correctly.

6. Setting Up the Excel File

A. Enable Macros

The software relies on macros; therefore, you must enable them to activate full automation. Once you allow them, the tool performs every function seamlessly.

B. Check Sheets Included

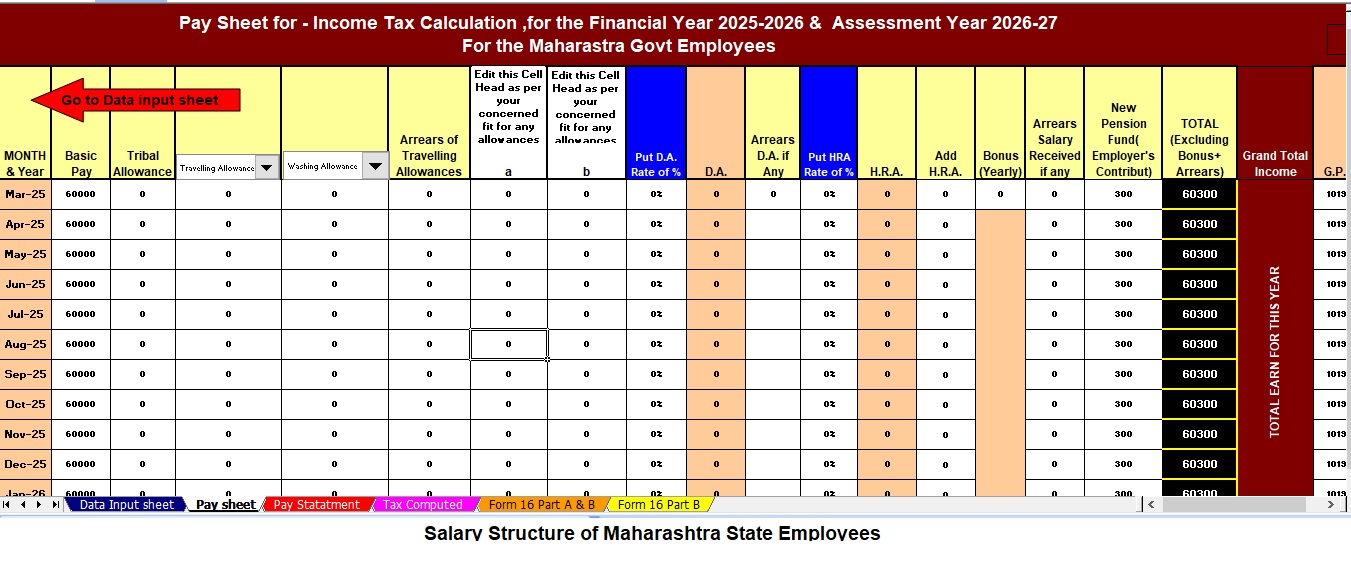

When the file opens, you immediately see important sheets such as:

- Salary Structure

- Deductions

- Tax Summary

- Form 16 Part A & B

Each sheet plays a crucial role; consequently, the entire tax filing process becomes organised, structured, and easy to follow.

7. Entering Your Income Details Correctly

To ensure full accuracy, follow these steps:

- First, enter salary details such as Basic Pay, DA, HRA, and Special Allowances.

- Next, record your investments and savings under Section 80C, 80D, 80CCD, and other relevant sections.

- Additionally, verify Maharashtra-specific allowances.

- Finally, review all entries carefully before continuing.

By following these steps, you guarantee precise, error-free tax results.

8. Choosing the Right Tax Regime in F.Y. 2025-26

A. Old Tax Regime

The old regime benefits you when you claim multiple deductions; therefore, it suits employees with higher investments.

B. New Tax Regime

The new regime offers lower tax rates; however, it provides fewer deductions. Consequently, it works well when you prefer simple tax filing.

The software then compares both regimes automatically and instantly suggests the most profitable option.

9. Automated Calculations and Deductions

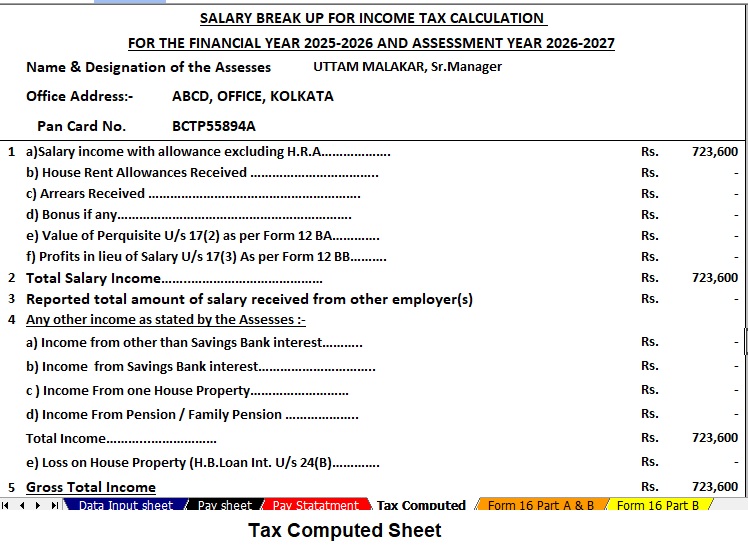

In this section, the tool performs exceptionally well. It automatically calculates:

- Total Gross Income

- Standard Deduction

- HRA Exemption

- Section 80C Deductions

- Taxable Income under both regimes

Afterwards, it organises every calculation seamlessly. Each step transitions smoothly from one stage to the next—just like flipping through neatly arranged diary pages.

10. How the Tool Prepares Form 16 and Other Reports

The software automatically fills Form 16 formats with your entries. Because this process is fully automated, you no longer need to prepare:

- Form 16 Part A

- Form 16 Part B

- Form 16 combined formats

Thus, you reduce manual work and, moreover, ensure consistently accurate reporting.

11. Tips to Avoid Common Tax Filing Mistakes

To avoid mistakes, always:

- Double-check personal details

- Ensure your PAN is correct

- Recheck savings declarations

- Select the right tax regime

- Verify allowances thoroughly

Following these steps helps you prevent unnecessary corrections later.

12. Benefits of Using an Excel-Based Tax System

An Excel-based tool gives you complete control. Unlike online portals, your data stays offline; therefore, you maintain full privacy. Additionally, you can review, compare, and revise entries anytime without internet access. Ultimately, you gain convenience, accuracy, and flexibility throughout the entire process.

13. Final Thoughts

To conclude, the Automatic Income Tax Preparation Software All in One in Excel for Maharashtra State Government Employees for F.Y. 2025-26 does much more than calculate taxes. It actively guides you step-by-step, simplifies your workload, and ensures accurate filing. Moreover, its automated features and user-friendly design transform your Income Tax process into a smooth, stress-free experience.

FAQs

1. How do I download the Automatic Income Tax Software for F.Y. 2025-26?

You can download it directly from the official website that provides Excel-based tax preparation tools.

2. Does the software support both the Old and New Tax Regimes?

Yes, the software supports both regimes and instantly compares them to show which option benefits you more.

3. Can Maharashtra government employees use this tool easily?

Absolutely! It is designed specifically for Maharashtra State Government employees.

4. Is the software safe to use?

Yes, the Excel tool works entirely offline, allowing you to maintain complete data privacy.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Maharashtra State Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can effortlessly choose between the New or Old Tax Regime under Section 115BAC. Furthermore, the tool automatically compares both regimes to help you identify the most tax-saving option. - Customised Salary Structure:

It automatically adjusts according to your salary format, whether you belong to a Government or Non-Government organisation. Additionally, this customisation reduces manual entry and saves valuable time. - Updated Form 16 (Part A & B and Part B):

This tool automatically generates Revised Form 16 (Part A & B and Part B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest tax formats. - Simplified Compliance:

It ensures quick and error-free tax computation through advanced built-in formulas. Furthermore, you can confidently prepare your return with zero manual intervention, enhancing both speed and accuracy.